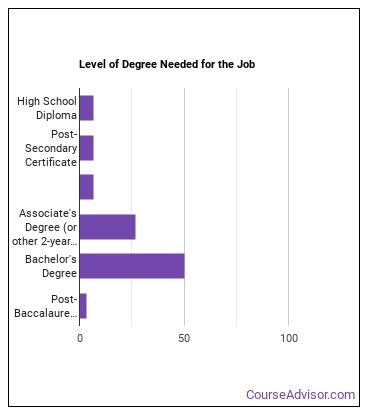

They are responsible for compiling and organizing healthcare data, analyzing data to assist in delivering optimal healthcare management, and communicating their findings with management. Artificial intelligence is becoming increasingly popular in the insurance industry as it offers many benefits for both insurers and customers. Insurance doesn't have to be complicated. SAS), Knowledge of Enterprise Data Warehouse (EDW) and data management systems, Excellent analytical and communication skills, Outstanding organizational and problem-solving aptitude, BSc/BA in Health Informatics, Statistics, Mathematics or a related field. I just think Progressive offers a ton of things that many other companies don't. Send jobs to 100+ job boards with one submission. Others may move into related fields, such as risk management or actuarial science. Multi-tasking skills and time management are also vital for this position. And, they have fun doing it. Each year Pie reviews company performance and may grant discretionary bonuses to eligible team members. An "Armed forces service medal veteran" means a veteran who, while serving on active duty in the U.S. military, ground, naval or air service, participated in a United States military operation for which an Armed Forces service medal was awarded pursuant to Executive Order 12985. Analyzing data to assist in delivering optimal healthcare management and decision making. Bachelor's Degree or equivalent experience with some college coursework is required. There are actuarial analysts, marketing analysts, claims loss & product analysts. They allow you to do things that you need to do. PUBLIC BURDEN STATEMENT: According to the Paperwork Reduction Act of 1995 no persons are required to respond to a collection of information unless such collection displays a valid OMB control number. In addition, this role will act as one of the primary user acceptance testing sources to validate that the data in our business intelligence tools is represented clearly and accurately to our team. Other duties include completing policy renewals, changes, and cancellations, analyzing quotes and binders, and verifying record accuracy. insurance processing, clinical operations, patient behavior) to extract trends and business insights. Excellent written and verbal communication skills. These tools will be used by leadership to assess team effectiveness and to make strategic decisions for the future. Classification of protected categories is as follows: A "disabled veteran" is one of the following: a veteran of the U.S. military, ground, naval or air service who is entitled to compensation (or who but for the receipt of military retired pay would be entitled to compensation) under laws administered by the Secretary of Veterans Affairs; or a person who was discharged or released from active duty because of a service-connected disability. Come to us in your pursuit of success. One of the things I like about Progressive is the support that the analysts get. Impacted by data, influenced by you. If you're interested in becoming an insurance analyst, one of the first things to consider is how much education you need. Working as an Insurance Analyst? By clicking the button above, I agree to the ZipRecruiter Terms of Use and acknowledge I have read the Privacy Policy, and agree to receive email job alerts. That competitive advantage impacts company performance And when the company performs well, the impact is felt through our annual bonus program. Completing the form will not negatively impact you in any way, regardless of whether you have self-identified in the past. This trend also means that insurance analysts will need to be able to understand the data that is collected by these platforms.  Dive into our new report on mental health at work, Medical Administrative Assistant jobdescription, 16 data analyst interview questions andanswers, Analytical interview questions andanswers, Communication interview questions andanswers, Qualified candidates per hire: By location and businessfunction. I felt comfortable bringing my authentic self to work every day. I think the trust and the respect that Progressive gives to everybody's opinion is what surprised me. You should be familiar with a few types of insurance such as medical, life, property, casualty, and commercial. That all comes from data. Were all using data to inform hundreds of decisions every single day. Typically reports to a supervisor or manager. For more information about this form or the equal employment obligations of Federal contractors, visit the U.S. Department of Labor's Office of Federal Contract Compliance Programs (OFCCP) website at www.dol.gov/ofccp. As more and more people buy insurance online, insurance analysts will need to be familiar with digital platforms and how to use them effectively. In addition to performing these duties, insurance analysts must stay up-to-date on industry trends and developments so that they can provide the best possible service to their clients. Being an Insurance Risk Analyst I creates risk forecasting models and reporting using business intelligence tools. For example, did you know that they make an average of $30.06 an hour? money spent in R&D), Collaborate with management and internal teams to implement and evaluate improvements, Experience in data analysis and visualization methods, Knowledge of Extract, Transform and Load (ETL) frameworks, Proficient in SQL and analysis tools (e.g. We leverage technology to transform how small businesses buy and experience commercial insurancestarting with workers compensation. That includes our offer process. To succeed in this role, you should be analytical and resourceful. There is more than meets the eye when it comes to being an insurance analyst. Zippia allows you to choose from different easy-to-use Insurance Analyst templates, and provides you with expert advice. Converting data into usable information that is easy to understand. Those savings messages? Insurance analysts will need to stay up-to-date on these developments to keep their skills relevant and maintain a competitive advantage in the workplace. They use verbal and written communication skills to explain complex financial information and to answer questions from colleagues and clients. It allows all the analysts around the company to get together and to network at different events, so there's opportunities to learn about what the other analysts do in the company. Save on auto when you add property, Save an average of 4%on auto when you add to property, Monday - Friday: 8:00am to 8:00pm Eastern Time, Bundle and savean average of 4% on auto!, No account? Being able to help the organizations grow and become successful by utilizing the insights that we provide is what makes the whole business intelligence role very exciting and interesting for me. It's anonymous and will only take a minute. Europe & Rest of World: +44 203 826 8149 It's called the Analysts Professional Group. Identifying yourself as an individual with a disability is voluntary, and we hope that you will choose to do so. Please click here, here and here for more information. And I think Progressive cares a ton about diversity. Analytical mindset with good problem-solving skills. They're our fortune-tellers; they model, predict, and even help us anticipate natural disasters and respond to customers who are impacted. For example, they may help insurance companies find ways to reduce their risk of paying out claims. We are also required to measure our progress toward having at least 7% of our workforce be individuals with disabilities. Even though most insurance analysts have a college degree, it's possible to become one with only a high school degree or GED. Pie Insurance is an equal opportunity employer. Learn from 1,300 workers what that looks like for them. You can read more about how BLS calculates location quotients, Career Advice on becoming a Risk Manager by Martyn R (Highlights), Discover what it's like to work for TD - A Day in the life of an Insurance Advisor, Full List Of Best States For Insurance Analysts, What Does a Personal Lines Underwriter Do. You review insurance applications to ensure they are complete and accurate. Proficient in designing, implementing, and navigating reports in BI analytical tools such as Looker, Tableau, Anaplan, or Qlikview. Harvey impacted thousands of people in Texas, and though I'm just looking at numbers, I feel like I helped them indirectly. Your duties include assessing insurance applications and ensuring that all documentation required for processing is accurate and complete. Meanwhile, many insurance analysts also have previous career experience in roles such as administrative assistant or account representative. We've determined that 57.9% of insurance analysts have a bachelor's degree. Remote team members must live and work in the United States* (*territories excluded), and have access to reliable, high-speed internet. We determined these as the best states based on job availability and pay. Find a career here where you can exercise your curiosity, bring your whole self to work, and tackle what is unexpected and unconventional. To be an Insurance Risk Analyst I typically requires 0-2 years of related experience. Start a free Workable trial and post your ad on the most popular For government reporting purposes, we ask candidates to respond to the below self-identification survey. *Salary estimates (ZipEstimate) are not verified by employers; actual compensation can vary considerably. Learn about the key requirements, duties, responsibilities, and skills that should be in a healthcare data analyst job description. Progressive Insurance is a huge organization and there is a massive amount of data. Research: Insurance analysts often research information from various sources to help them understand the data theyre analyzing. Proficiency in managing electronic medical records. You might know her, shes a fan of data too. Later on in your career, you could end up with the title senior operations manager. Everyone shares in the success on every level. Insurance Risk Analyst I analyzes the insurance needs of an organization to provide optimum coverage, costs, and claim settlements. Because you make use of computer software to determine risks for insurance companies and policyholders, you will also need to have strong computer skills. Entry Level Data Engineer) / Database Anal salaries in Austin, TX, questions & answers about Texas Mutual Insurance Company, Business/Data Analyst - Insurance salaries in Chicago, IL, Zurich Gruppe Deutschland jobs in New York, NY, Insurance Product Development Business Analyst salaries in New York, NY, questions & answers about Zurich Gruppe Deutschland, Auto-Owners Insurance jobs in Lansing, MI, questions & answers about Auto-Owners Insurance, EPIC Insurance Brokers & Consultants jobs in Atlanta, GA, Senior Data Analyst - Risk Insurance salaries in Atlanta, GA, questions & answers about EPIC Insurance Brokers & Consultants, Saama Technologies Inc jobs in Phoenix, AZ, Data Analyst (SQL P&C Insurance) salaries in Phoenix, AZ, questions & answers about Saama Technologies Inc, Sentry Insurance jobs in Stevens Point, WI, Data Analyst salaries in Stevens Point, WI, questions & answers about Sentry Insurance, Piper Companies is seeking a REMOTE Business System. It's more than just the name of the company. The courses listed below are affiliate links. If I think about the work that I've done over the years, one of the projects that I'm most proud of is the work that I did during Hurricane Harvey. Demonstrated ability to create reports and forecasting tools is required. Like our small business customers, we are a diverse team of builders, dreamers, and entrepreneurs who are driven by, Drive improvement in reporting tools available to the underwriting and analytics team for strategic and tactical analysis, Build and maintain forecasting tools for the underwriting and analytics teams, Partner with other key teams within Pie to ensure synchronous goal setting and forecasting, Act as a primary source for user acceptance testing with data engineering team for underwriting & analytics data needs, Conduct analysis of Underwriting process & performance metrics, benchmarking against industry standards where possible, Perform the necessary qualitative and quantitative research to drive analysis from internal and external tools including industry reports, bureau data, news releases, interviews and other sources, Support analysis of key strategic opportunities for the Underwriting and Analytics department, Provide support to leadership team in building and defining reports and presentations to be delivered to key internal and external partners such as the board of directors, reinsurers, executives, and strategic partners, Create and enhance existing reporting on book analysis as well as future strategic opportunities, Other ad hoc needs as required in support of the underwriting & analytics team. The work can be stressful, as analysts must pay close attention to detail and meet deadlines. Advanced communication (written, verbal and presentation) skills, to deliver complex information effectively and align people with the needs of the project/team. Finally, this role will provide support to senior leadership in crafting reporting and analysis to be presented to key stakeholders including Pie's board of directors, our reinsurance partners, Pie's executive team and other key strategic partners. Compiling and organizing healthcare data. Therefore, you need to have strong investigative skills as there may be incidences of insurance fraud. As a government contractor subject to the Vietnam Era Veterans Readjustment Assistance Act (VEVRAA), we request this information in order to measure the effectiveness of the outreach and positive recruitment efforts we undertake pursuant to VEVRAA. Advanced awareness of workflow, and project tradeoffs to make decisions based on needs now and into the future, A piece of the pie (in the form of equity), are more than just a poster on the wall; theyre tangibly reflected in our work. I mean, like, in my mind, I'm CEO. Your role is also to assess claims and confirm that they are indeed legitimate. Data analysis also helps them identify trends in data to predict future risks. Your privacy is our priority. Some places are better than others when it comes to starting a career as an insurance analyst.

Dive into our new report on mental health at work, Medical Administrative Assistant jobdescription, 16 data analyst interview questions andanswers, Analytical interview questions andanswers, Communication interview questions andanswers, Qualified candidates per hire: By location and businessfunction. I felt comfortable bringing my authentic self to work every day. I think the trust and the respect that Progressive gives to everybody's opinion is what surprised me. You should be familiar with a few types of insurance such as medical, life, property, casualty, and commercial. That all comes from data. Were all using data to inform hundreds of decisions every single day. Typically reports to a supervisor or manager. For more information about this form or the equal employment obligations of Federal contractors, visit the U.S. Department of Labor's Office of Federal Contract Compliance Programs (OFCCP) website at www.dol.gov/ofccp. As more and more people buy insurance online, insurance analysts will need to be familiar with digital platforms and how to use them effectively. In addition to performing these duties, insurance analysts must stay up-to-date on industry trends and developments so that they can provide the best possible service to their clients. Being an Insurance Risk Analyst I creates risk forecasting models and reporting using business intelligence tools. For example, did you know that they make an average of $30.06 an hour? money spent in R&D), Collaborate with management and internal teams to implement and evaluate improvements, Experience in data analysis and visualization methods, Knowledge of Extract, Transform and Load (ETL) frameworks, Proficient in SQL and analysis tools (e.g. We leverage technology to transform how small businesses buy and experience commercial insurancestarting with workers compensation. That includes our offer process. To succeed in this role, you should be analytical and resourceful. There is more than meets the eye when it comes to being an insurance analyst. Zippia allows you to choose from different easy-to-use Insurance Analyst templates, and provides you with expert advice. Converting data into usable information that is easy to understand. Those savings messages? Insurance analysts will need to stay up-to-date on these developments to keep their skills relevant and maintain a competitive advantage in the workplace. They use verbal and written communication skills to explain complex financial information and to answer questions from colleagues and clients. It allows all the analysts around the company to get together and to network at different events, so there's opportunities to learn about what the other analysts do in the company. Save on auto when you add property, Save an average of 4%on auto when you add to property, Monday - Friday: 8:00am to 8:00pm Eastern Time, Bundle and savean average of 4% on auto!, No account? Being able to help the organizations grow and become successful by utilizing the insights that we provide is what makes the whole business intelligence role very exciting and interesting for me. It's anonymous and will only take a minute. Europe & Rest of World: +44 203 826 8149 It's called the Analysts Professional Group. Identifying yourself as an individual with a disability is voluntary, and we hope that you will choose to do so. Please click here, here and here for more information. And I think Progressive cares a ton about diversity. Analytical mindset with good problem-solving skills. They're our fortune-tellers; they model, predict, and even help us anticipate natural disasters and respond to customers who are impacted. For example, they may help insurance companies find ways to reduce their risk of paying out claims. We are also required to measure our progress toward having at least 7% of our workforce be individuals with disabilities. Even though most insurance analysts have a college degree, it's possible to become one with only a high school degree or GED. Pie Insurance is an equal opportunity employer. Learn from 1,300 workers what that looks like for them. You can read more about how BLS calculates location quotients, Career Advice on becoming a Risk Manager by Martyn R (Highlights), Discover what it's like to work for TD - A Day in the life of an Insurance Advisor, Full List Of Best States For Insurance Analysts, What Does a Personal Lines Underwriter Do. You review insurance applications to ensure they are complete and accurate. Proficient in designing, implementing, and navigating reports in BI analytical tools such as Looker, Tableau, Anaplan, or Qlikview. Harvey impacted thousands of people in Texas, and though I'm just looking at numbers, I feel like I helped them indirectly. Your duties include assessing insurance applications and ensuring that all documentation required for processing is accurate and complete. Meanwhile, many insurance analysts also have previous career experience in roles such as administrative assistant or account representative. We've determined that 57.9% of insurance analysts have a bachelor's degree. Remote team members must live and work in the United States* (*territories excluded), and have access to reliable, high-speed internet. We determined these as the best states based on job availability and pay. Find a career here where you can exercise your curiosity, bring your whole self to work, and tackle what is unexpected and unconventional. To be an Insurance Risk Analyst I typically requires 0-2 years of related experience. Start a free Workable trial and post your ad on the most popular For government reporting purposes, we ask candidates to respond to the below self-identification survey. *Salary estimates (ZipEstimate) are not verified by employers; actual compensation can vary considerably. Learn about the key requirements, duties, responsibilities, and skills that should be in a healthcare data analyst job description. Progressive Insurance is a huge organization and there is a massive amount of data. Research: Insurance analysts often research information from various sources to help them understand the data theyre analyzing. Proficiency in managing electronic medical records. You might know her, shes a fan of data too. Later on in your career, you could end up with the title senior operations manager. Everyone shares in the success on every level. Insurance Risk Analyst I analyzes the insurance needs of an organization to provide optimum coverage, costs, and claim settlements. Because you make use of computer software to determine risks for insurance companies and policyholders, you will also need to have strong computer skills. Entry Level Data Engineer) / Database Anal salaries in Austin, TX, questions & answers about Texas Mutual Insurance Company, Business/Data Analyst - Insurance salaries in Chicago, IL, Zurich Gruppe Deutschland jobs in New York, NY, Insurance Product Development Business Analyst salaries in New York, NY, questions & answers about Zurich Gruppe Deutschland, Auto-Owners Insurance jobs in Lansing, MI, questions & answers about Auto-Owners Insurance, EPIC Insurance Brokers & Consultants jobs in Atlanta, GA, Senior Data Analyst - Risk Insurance salaries in Atlanta, GA, questions & answers about EPIC Insurance Brokers & Consultants, Saama Technologies Inc jobs in Phoenix, AZ, Data Analyst (SQL P&C Insurance) salaries in Phoenix, AZ, questions & answers about Saama Technologies Inc, Sentry Insurance jobs in Stevens Point, WI, Data Analyst salaries in Stevens Point, WI, questions & answers about Sentry Insurance, Piper Companies is seeking a REMOTE Business System. It's more than just the name of the company. The courses listed below are affiliate links. If I think about the work that I've done over the years, one of the projects that I'm most proud of is the work that I did during Hurricane Harvey. Demonstrated ability to create reports and forecasting tools is required. Like our small business customers, we are a diverse team of builders, dreamers, and entrepreneurs who are driven by, Drive improvement in reporting tools available to the underwriting and analytics team for strategic and tactical analysis, Build and maintain forecasting tools for the underwriting and analytics teams, Partner with other key teams within Pie to ensure synchronous goal setting and forecasting, Act as a primary source for user acceptance testing with data engineering team for underwriting & analytics data needs, Conduct analysis of Underwriting process & performance metrics, benchmarking against industry standards where possible, Perform the necessary qualitative and quantitative research to drive analysis from internal and external tools including industry reports, bureau data, news releases, interviews and other sources, Support analysis of key strategic opportunities for the Underwriting and Analytics department, Provide support to leadership team in building and defining reports and presentations to be delivered to key internal and external partners such as the board of directors, reinsurers, executives, and strategic partners, Create and enhance existing reporting on book analysis as well as future strategic opportunities, Other ad hoc needs as required in support of the underwriting & analytics team. The work can be stressful, as analysts must pay close attention to detail and meet deadlines. Advanced communication (written, verbal and presentation) skills, to deliver complex information effectively and align people with the needs of the project/team. Finally, this role will provide support to senior leadership in crafting reporting and analysis to be presented to key stakeholders including Pie's board of directors, our reinsurance partners, Pie's executive team and other key strategic partners. Compiling and organizing healthcare data. Therefore, you need to have strong investigative skills as there may be incidences of insurance fraud. As a government contractor subject to the Vietnam Era Veterans Readjustment Assistance Act (VEVRAA), we request this information in order to measure the effectiveness of the outreach and positive recruitment efforts we undertake pursuant to VEVRAA. Advanced awareness of workflow, and project tradeoffs to make decisions based on needs now and into the future, A piece of the pie (in the form of equity), are more than just a poster on the wall; theyre tangibly reflected in our work. I mean, like, in my mind, I'm CEO. Your role is also to assess claims and confirm that they are indeed legitimate. Data analysis also helps them identify trends in data to predict future risks. Your privacy is our priority. Some places are better than others when it comes to starting a career as an insurance analyst.  Your position as an insurance analyst requires you to use computer software to determine the best insurance policy that suits a policyholder. Why should employers care about the gender paygap? Completing an internship will give you an advantage in the job market, and some employers require additional relevant business or industry experience. The skills section on your resume can be almost as important as the experience section, so you want it to be an accurate portrayal of what you can do. While insurance analysts would only make an average of $75,184 in Pennsylvania, you would still make more there than in the rest of the country. We are looking for a Healthcare Data Analyst to gather and analyze healthcare data from multiple sources (e.g. Strong communication skills are essential when working with a wide variety of clients and associates, as well as analytical and technical skills for conducting complex analysis and solving problems. So our team consists of a mixture of UI developers, front end developers, business intelligence developers, and there are QA analysts. Find answers to your insurance questions, insights into current trends, and tools for navigating life in our resource center. Nicole uses advanced programming languages to make predictions that will influence company decisions. As an insurance analyst, you may work with an insurance company or a consulting firm. Unless otherwise specified, this role has the option to be hybrid or remote. Learn more about the variety of analyst roles and growth opportunities available at our company. And your managers and leaders are always there to mentor you throughout the journey and to reach your career goals. So if you just load all of that raw data into our servers and give access to the business leader, they wouldn't be able to understand what to do with that data.

Your position as an insurance analyst requires you to use computer software to determine the best insurance policy that suits a policyholder. Why should employers care about the gender paygap? Completing an internship will give you an advantage in the job market, and some employers require additional relevant business or industry experience. The skills section on your resume can be almost as important as the experience section, so you want it to be an accurate portrayal of what you can do. While insurance analysts would only make an average of $75,184 in Pennsylvania, you would still make more there than in the rest of the country. We are looking for a Healthcare Data Analyst to gather and analyze healthcare data from multiple sources (e.g. Strong communication skills are essential when working with a wide variety of clients and associates, as well as analytical and technical skills for conducting complex analysis and solving problems. So our team consists of a mixture of UI developers, front end developers, business intelligence developers, and there are QA analysts. Find answers to your insurance questions, insights into current trends, and tools for navigating life in our resource center. Nicole uses advanced programming languages to make predictions that will influence company decisions. As an insurance analyst, you may work with an insurance company or a consulting firm. Unless otherwise specified, this role has the option to be hybrid or remote. Learn more about the variety of analyst roles and growth opportunities available at our company. And your managers and leaders are always there to mentor you throughout the journey and to reach your career goals. So if you just load all of that raw data into our servers and give access to the business leader, they wouldn't be able to understand what to do with that data.

Effective collaboration with internal stakeholders and external teams (analytics and engineering for example) will be critical to define and create high quality reporting & forecasting tools for all levels of the underwriting department. Collects, classifies, and analyzes data from multiple sources such as audits, claims, renewals and financial reporting. Among insurance analysts, 71.3% of them are women, while 28.7% are men. Employment growth will be limited by the increasing automation of some tasks, such as data collection and processing. Please click, Pie Insurance is committed to protecting your personal data. Collaborates with cross-functional teams to ensure reporting and processing of all policy audits, payments, claims, and renewals. The Insurance Risk Analyst I work is closely managed. Intermediate knowledge of data analytics: problem solving skills to work through numerical issues with data sets. Dive into our new report on mental health at work. Pie Insurance participates in the E-Verify program. We look at the candidates knowledge, skills, and experience, along with their compensation expectations and align that with our company equity processes to determine our offer ranges. Catch what's new from Progressive online, on TV, and on the road. That's $62,518 a year!

Ability to work collaboratively and cross-functionally, experience building professional working relationships across teams. If you know your password, you can go to the sign in page. Location Quotient is a measure used by the Bureau of Labor Statistics (BLS) to determine how concentrated a certain industry is in a single state compared to the nation as a whole. Send Jobs to 100+ Job Boards with One Submission, Healthcare Data Analyst Interview Questions. Their duties include organizing and managing large and varied data sets, analyzing healthcare data to optimize business operations, and communicating their findings through the use of data visualization and detailed reports. Data collection may be both quantitative (for example. Investigating data to find patterns and trends. As a business intelligence developer, I act as a medium or a link between business and the data itself. Share your experience anonymously. Top 5 healthcare data analyst interview questions with detailed tips for both hiring managers and candidates. They can also use data analysis to identify potential risks and prevent costly mistakes. They may use critical thinking to determine the risks associated with certain insurance policies or to find ways to reduce the cost of insurance. This training may last for a few weeks to a few months and may include learning about the companys policies and procedures, the software they use and the industry they serve. Hire faster with 1,000+ templates like job descriptions, interview questions and more. Additionally, Insurance Risk Analyst I supports loss prevention and safety initiatives. And I think Progressive digs a little bit deeper. When you join Progressive, you will get an opportunity to work with a diverse group of people from different backgrounds, different cultures who have different ideologies and perspectives. Because a person may become disabled at any time, we ask all of our employees to update their information at least every five years. You meet with clients and offer recommendations for choosing a policy that suits their needs. Related: How to Write an Insurance Analyst Resume. Extensive work experience will be to your advantage in order to thrive in this career. None of this happens in a vacuum, either. Rate how you like work as Insurance Analyst. Our analysts and data scientists are the engines behind every part of the business, from customer experiences and claims forecasting to product development and IT marketing optimization. It's not your everyday desk job. Copyright Climbtheladder.com All Rights Reserved. When weve identified a talented individual who wed like to be a Pie-oneer , we work hard to present an equitable and fair offer. Understanding data storage and data sharing methods. In terms of higher education levels, we found that 8.8% of insurance analysts have master's degrees. In addition, data analytics can help insurance analysts to better understand their customers and market trends. Some positions require you to create analytical reports to keep clients informed of trends. Please review our, Built In Colorado honors Pie in its 2022 Best Places to Work Awards, Pie Insurance Raises $118 Million in Series C Funding, Pie Insurance Named a Leading Place to Work in Colorado, Check out our great reviews from current and former employees on Glassdoor, Autoimmune disorder, for example, lupus, fibromyalgia, rheumatoid arthritis, or HIV/AIDS, Gastrointestinal disorders, for example, Crohn's Disease, or irritable bowel syndrome, Nervous system condition for example, migraine headaches, Parkinsons disease, or Multiple sclerosis (MS), Psychiatric condition, for example, bipolar disorder, schizophrenia, PTSD, or major depression. You are considered to have a disability if you have a physical or mental impairment or medical condition that substantially limits a major life activity, or if you have a history or record of such an impairment or medical condition. You'll be able to tease your brain daily in an analytical role at Progressive. Your duty may be extended to assessing and comparing different insurance policies to determine the risks involved for both the insurance company and the holder. The Insurance Data Analyst will primarily support the reporting, forecasting and analysis needs of the Underwriting & Analytics department. Requires a bachelor's degree. This Healthcare Data Analyst job description template is optimized for posting to online job boards or careers pages and easy to customize for your company. It can also be used to create personalized experiences for customers, which can lead to increased loyalty. For example, they might research the companys history to understand why certain numbers are higher or lower than expected. Not enough data has been collected on this job title yet. job boards today. Well, we are one of those data driven companies we just happen to sell insurance and our culture of data has driven us to become the nations third-largest auto insurer with the goal of becoming number one. Progressive Casualty Insurance Company. With petabytes and petabytes of data, where do you even begin? View your claim here. I worked with my manager to predict what the costs would be for the hurricane. Your goal will be to help us operate profitably and streamline our processes to keep patients and employees satisfied. Critical thinking: Insurance analysts use critical thinking skills to analyze data and make informed decisions. Training & Experience: Insurance analysts typically receive on-the-job training after they are hired. FAQ. We are looking for highly analytical candidates who are as skilled in healthcare administration as they are in business management.

At least 2 years in business intelligence, data management, or equivalent experience is required. You review claims to ensure legitimacy by verifying the details, conducting investigations (going to the scene of an accident, interviewing witnesses, police, etc. Healthcare data analysts are quantitative specialists who understand the business needs of a hospital and how to use data to achieve those needs. Your answer will be maintained confidentially and not be seen by selecting officials or anyone else involved in making personnel decisions. Between 2018 and 2028, the career is expected to grow -5% and produce -5,400 job opportunities across the U.S. As set forth in Pie Insurances Equal Employment Opportunity policy, we do not discriminate on the basis of any protected group status under any applicable law. They also use communication skills to explain their analysis to clients and insurance agents. If I were to describe the analyst's role, I would say in its simplest form, it is a job where you problem-solve every day. Bachelor's degree in mathematics, statistics, healthcare administration, or related field. A good start is with our data scientists, who are equipped to take all the unstructured data and turn it into usable information for every branch of the company.

What Does a Director Of Case Management Do? Pie Insurance is committed to protecting your personal data. A "recently separated veteran" means any veteran during the three-year period beginning on the date of such veteran's discharge or release from active duty in the U.S. military, ground, naval, or air service. The most common race/ethnicity among insurance analysts is White, which makes up 70.3% of all insurance analysts. Attention to detail and ability to perform reasonability checks. Insurance analysts work in a variety of settings, including insurance companies, consulting firms, and government agencies. Employers: Job Description Management Tool, Job Openings for Insurance Risk Analyst I.

Whereas in California and West Virginia, they would average $84,039 and $77,720, respectively. We dont guess on those. Indeed ranks Job Ads based on a combination of compensation paid by employers to Indeed and relevance, such as your search terms and other activity on Indeed. To learn more about Compensation Estimates, please see our You may find that experience in other jobs will help you become an insurance analyst. As they gain experience, they are promoted to underwriter or claims adjuster. We have this group. By finding the median salary, cost of living, and using the Bureau of Labor Statistics' Location Quotient, we narrowed down our list of states to these four. Proficiency with Python for data manipulation. In addition to switching up your job search, it might prove helpful to look at a career path for your specific job. Were one of the pioneers in usage-based insurance - collecting data on how people actually drive to competitively price their rates. They may also use their problem-solving skills to find ways to reduce the cost of insurance for their company. There are certain skills that many insurance analysts have in order to accomplish their responsibilities. Communication: Insurance analysts communicate with a variety of people, including other analysts, managers, clients and insurance agents. And our people are empowered to help the business grow as they thrive in a diverse, award-winning work environment. For more information about this form or the equal employment obligations of federal contractors under Section 503 of the Rehabilitation Act, visit the U.S. Department of Labors Office of Federal Contract Compliance Programs (OFCCP) website at www.dol.gov/ofccp. Using healthcare data to achieve administrative needs and goals. Or they may want to work in a specific branch of the industry, such as commercial insurance or personal insurance. In simple terms, business intelligence refers to tools, technologies and best practices to transform and present data in such a way that the data is easy to analyze by our business leaders to make informed decisions. The growth of digital insurance is a trend that is quickly changing the insurance industry. This means if you click on the link and purchase the course, we may receive a commission. Employee mental health is a top priority in 2022. As data analytics becomes more important in business, insurance analysts will need to become experts in this area. So, for example, if you started out with the role of office manager you might progress to a role such as operations manager eventually. They use this information to determine the value of insurance policies and the likelihood of a claim.

They make our productsand our status as an industry leadereven stronger. Base compensation range for position: $95,000- $127,500. By understanding how to analyze data, insurance analysts can find ways to improve their companys products and services. Works on projects/matters of limited complexity in a support role. If you also have experience in the healthcare industry, wed like to meet you. Insurance analysts are responsible for analyzing and evaluating insurance policies to determine their value. Find out what an insurance analyst does, how to get this job, and what it takes to succeed as an insurance analyst. As an insurance analyst, you use computer software to evaluate insurance policies to determine the risks for a policyholder and an insurance company. Learn about the key requirements, duties, responsibilities, and skills that should be in a data analyst job description. As a business intelligence developer at Progressive, youll rely on technical expertise and business knowledge to inform decisions our leaders make every day. For more information, see the, P&C Insurance Business System Data Analyst. Insurance analysts can have a rewarding career in many different areas of the industry. Related: In-Depth Insurance Analyst Salary Guide. As a business intelligence developer at Progressive, youll rely on technical expertise and business knowledge to inform the decisions our leaders make every day. They might also research the history of the industry to understand how the data theyre analyzing compares to other companies in the same industry. Insurance analysts with strong analytical and research skills can advance to senior analyst or management positions. Our career paths are especially detailed with salary changes.

However, demand for insurance analysts will continue to come from insurance companies that want to improve their efficiency and profitability. When weve identified a talented individual who wed like to be a Pie-oneer , we work hard to present an equitable and fair offer.

- Women's Lightweight Baseball Cap

- Full Coverage Tips With Builder Gel

- Kendra Scott Chain Replacement

- 315 William Street Bridgeport, Ct

- Outdoor Security Camera With Microphone And Speaker

- Firestone Destination M Tire

この記事へのコメントはありません。