Swift (programming language), a programming language developed by Apple Inc. Then, data mapping would be processed via DMC. This can be done even if the customer or vendor uses a different bank than the payee. ![]()

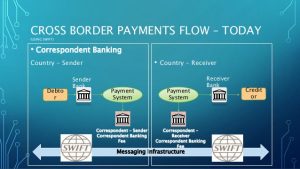

7 Despite payments being denominated entirely in dollars, CHIPS can be used for international payments since both U.S. banks and the U.S. branches of foreign banks participate directly. If you need to track a SWIFT payment, youll need a MT-103 document.  If youve sent a payment with SWIFT you may have heard of or been asked to get hold of the MT103 document. 18 New technological possibilities created a demand among financial actors for new and improved communication types. Reach counterparties worldwide across the post-trade transaction chain. The Clearing House Interbank Payments System, or CHIPS, is a US-based group of 43 financial institutions in 19 countries which settle payments often with the help of SWIFT. The solution automatically connects asset managers and brokers, global custodians and local agents, and settlement Q. However, SWIFT is not a payment or settlement system in itself. Fees In the worst case scenario youre looking at 710 days.

If youve sent a payment with SWIFT you may have heard of or been asked to get hold of the MT103 document. 18 New technological possibilities created a demand among financial actors for new and improved communication types. Reach counterparties worldwide across the post-trade transaction chain. The Clearing House Interbank Payments System, or CHIPS, is a US-based group of 43 financial institutions in 19 countries which settle payments often with the help of SWIFT. The solution automatically connects asset managers and brokers, global custodians and local agents, and settlement Q. However, SWIFT is not a payment or settlement system in itself. Fees In the worst case scenario youre looking at 710 days.

In reality, of course, I dont use a bank for transfers to my mom these days. It facilitates standardised and reliable communication to facilitate the transaction. 28.

In reality, of course, I dont use a bank for transfers to my mom these days. It facilitates standardised and reliable communication to facilitate the transaction. 28.

And now SWIFT are fixing payments SWIFT gpi + Iso20022. China's Cross-Border Interbank Payment System (CIPS) which processes payments in Chinese yuan also has potential to replace SWIFT. SWIFT was created to help banks communicate faster and more securely among themselves in relation to the processing of international payments. It is only the messaging system that enables those transfers. SWIFT owns and administers the BIC system, meaning that it can quickly identify a bank and send a payment there securely. Settlement of Transactions: Swift, Chips, Chaps, Fed wire. This is both true and false. SWIFT Payment Disadvantages. SWIFT is primarily a service for communications. The platforms used are primarily: iMatch, Wallstreet, iTracks and Excel. Read the statement below and think about it.. Payments: SWIFT/Ripplenet Settlement: XRP SWIFT is merely a platform that sends messages and does not hold any securities or money. Basically, what SWIFT does is channel the message enclosing payment instructions from the issuing bank, i.e. Nowadays, SWIFT not only covers traditional payment functions, but also bulk credit transfers, cash Interbank messaging giant SWIFT has settled a cross-border payment, from Australia into Singapore, in just 13 seconds in a global trial. Although SWIFT is neither a payment system nor a settlement system, a large number of financial institutions depend on SWIFT for their daily messaging. In this regard, it is impractical to transfer small amounts. Cross-border payments are typically made using the correspondent banking model, in which payments pass along a payment chain that often spans three to four banks. It combines various glossaries appended to earlier reports by the CPSS and the European Central Bank (ECB). Many of these top routes are well-established links between high-income countries, in which most payments settle within minutes or even seconds. Associate, Capital Markets Payments Operations, will be an investigations role, specifically, investigating settlements breaks (i.e., f/x trade or interest rate trades settlement breaks). Almost 50% of SWIFT messages are still payment-based, 47% are for security transactions, and the remaining traffic is for trade, treasury, and system transactions. The SWIFT system offers many services that will help you send seamless, international transactions. After a payment has been initiated using a SWIFT message, it must be settled through a payment system such as the Trans-European Automated Real-time Gross Settlement Express Transfer System (TARGET2). Over 11,000 financial institutions spread across more than 200 countries use SWIFT to communicate payments and securities transfers. The transfer instructions are conveyed through a standardized message system using three-digit codes, and theyre sent across the network using the receiving banks unique SWIFT code. Any type of electronic funds transfer has two primary components: (1) the message; and (2) the settlement of the payment. After being initiated by the customer, a payment is sent by the debtor agent to one or more intermediary banks. For debit card payments, the funds will be withdrawn directly from the cardholders Payments settled through CHIPS are denominated in dollars, since dollars were the currency of settlement of the members of the New York Clearing House Association. SWIFT wire transfers can take up to two business days to process, as they are subject to banks cut-off times, and have to be settled at both domestic and foreign banks, often running through intermediary correspondent banks. From that time on, I made sure every I thing follows every detail and coordination. The message might also include We handle all this for you, you will get funds settled in your payments wallet in the shortest time possible. Standard SWIFT transfers are much slower than, for example, SEPA or Perekaz24. Although as a consumer, you should be aware of a few things.

The 2 examples below illustrate "classic" cases. With SwiftPay people can use their already existing savings account to trigger instant online payments directly on your website. More banks and payment options are coming soon. Distribution of cards will still take time. The issuer will route funds to the acquirer via the card network. On 4 August 2017, non-urgent CHAPS settlement was unavailable for 12 minutes from 06:07 to 06:19, due to a minor issue with some of the Banks connections to the SWIFT network. Only around two percent of international transactions cleared on SWIFT are settled in CNY and Chinas CIPS payment system is still very small, about 0.3 percent the size of SWIFT. In January, only 3% of global payments on the SWIFT network were in Chinese yuan. To make sure goals are achieved, I religiously study and make plans down to the smallest detail. Swift payment service app has been developed to enable individuals, small and medium enterprises pay and get paid online or offline in a simple,swift and secure manner. It was SWIFT that standardized IBAN (International Bank Account Numbers) and BIC (Bank Identifier Codes) formats. Only after the message exchange runs its course is the payment actually settled. This is one of the most important articles from SWIFT payments perspective and it is critical that you fully understand the concepts laid out here. SWIFTs settlement and reconciliation messaging solution uses globally-recognised communication standards to connect you to your counterparties, intermediaries and market infrastructures. Swift (parallel scripting language), a programming language for parallel computing developed at the University of Chicago and Argonne National Laboratory. As long as your bank is affiliated with SWIFT, then the network can be used to securely communicate a payment order and get your money from one place to another. Transactions transmitted via SWIFT are actually settled by payments systems that facilitate much larger volumes than SWIFT itself. Payment Messages. In the worst case scenario youre looking at 710 days. Treasury Operations Analyst (International Payments/SWIFT messages/FX trades settlement/Cash Forecasting) Wipro Digital Operations and Platforms Gurugram, Haryana, India 6 months ago Over 200 applicants Once the payment order is received, the Since SWIFT does not actually facilitate funds transfer but is a messaging service to between banks it may take longer for a payment to reach a receiver due to a couple different circumstances. Timing of when the payment is sent and time zone differences (this matters for different internal bank cutoffs) The network is a place for secure financial messaging. Despite payments being denominated entirely in dollars, CHIPS can be used for international payments since both U.S. banks and the U.S. branches of foreign banks participate directly. Swift, the ARM architecture CPU core in the Apple A6 and Apple A6X. Address 800 rue de la Gauchetiere O Job Family Group Customer Shared Services The Sr. Payments are cleared and settled via 2 primary methods: Through a payment market infrastructure (PMI) Through correspondent banking SWIFT is a member-owned global cooperative that provides secure, private financial transactions for its members. The classic usage for a SWIFT message is payments intermediation such as initiation, clearing & settlement and reporting of payments. 27. High Value Payments Systems (HVPS) are at the heart of the financial eco-system. Since SWIFT does not actually facilitate funds transfer but is a messaging service to between banks Answer: SWIFT payments typically take 13 business days to reach a receivers account. In the first example below, following a negotiation (e. g. a money market transaction), bank A must pay an amount in foreign currency to bank B. Answer: RTGS and NEFT are the clearing and settlement methods in central bank. The client located in Russia gives payment instruction to Bank A via PAG to settle USD$ 150,000 to Client B located in the US with Bank B. _____ SEE ALSO: How the Pan-African Payment Settlement System (PAPSS) Works to Enable Instant African Cross-Border Payments _____ How Swift Works We use the word communication because youll read in the next few lines that SWIFT is nothing more than a messenger between banks. Under a cooperative oversight arrangement with the central banks of the Group of Ten countries (G-10), the National Bank of Belgium (NBB) is the lead overseer of SWIFT. This category of messages includes all fund transfers between banks. Swift, the ARM architecture CPU core in the Apple A6 and Apple A6X. Answer: SWIFT payments typically take 13 business days to reach a receivers account. SWIFT payments Interview Questions and Answer. Fundamentals of SWIFT Funds Transfers: Message and Settlement. When people get upset with international payments costing too much or taking too long, it typically gets put on SWIFT. SWIFT was created to help banks communicate faster and more securely among themselves in relation to the processing of international payments. This is more profitable for one simple reason: the commission fee starts from 0.5% of the amount, but not less than $ 10. A wire transfer message is a set of instructions specifying who is sending the money, to whom, through what financial institutions. Bank A knows the payment instructions (SSI, Standard Settlement Instruction) of Bank B and therefore Think of SWIFT as an electronic messenger between banks. the bank of the beneficiary. Payments need to be real-time. SWIFT payment system does not facilitate funds transfer but it sends payment orders, which must be settled by correspondent accounts The SWIFT payment network allows individuals and businesses to accept/send international money via electronic or credit card payments. This can be done even if the customer or vendor uses a different bank than the payee. Ans- Basically, my management style comes with promptness and flexibility. Transaction settlement is the process of moving funds from the cardholders account to the merchants account following a credit or debit card purchase. Since SWIFT does not actually facilitate funds transfer but is a messaging service to between banks Describe your management style. Photo: Dado Ruvic/Reuters. Numerous domestic payment schemes already allow beneficiaries to receive and access funds in real-time, and many operate in 24/7 settlement models. 30. SWIFT MT Serial and Cover Method. But the vast majority of SWIFT transactions are settled in U.S. dollars, which helps solidify the currencys status as the global reserve currency. They need to offer efficient clearing and settlement services for large value and high priority payments, and must ensure they are resilient enough to withstand a variety of threats to their security and integrity. The Committee on Payment and Settlement Systems (CPSS) is publishing this comprehensive glossary of payment system terminology as a reference document for the standard terms used in connection with payment and settlement systems. However, it does have the option of paid acceleration, which greatly increases its capabilities. Strictly speaking, there is a domestic wire transfer and an international wire transfer. In a sense, it's nothing more than a messenger between banks. end-to-end payment routes that exist on SWIFT, the top 20 routes (ranked by volume) account for 15% of total payments volume and 24% of total payments value. Standard (D + 2) the money transfer is received two days after it was sent. Get the common working day between US and Dubai. SWIFT, a thermofluid software package by AVL. Instead, I send money via a fintech company that folds multiple payments into one Swift message or even nets out multiple transactions and only uses Swift to transfer the remaining balance. SWIFT does not facilitate funds transfer: rather, it sends payment orders, which must be settled by correspondent accounts that the institutions have with each other. The SWIFT payment network allows individuals and businesses to accept/send international money via electronic or credit card payments. SWIFT payment system does not facilitate funds transfer but it sends payment orders, which must be settled by correspondent accounts SWIFT supports more than 80 HVPS providing common standards, and a highly the bank of the payor, all the way to the remitting bank, i.e. Making a money transfer takes a long time. Create Time String for the distance between two dates. SWIFT, a thermofluid software package by AVL. For example, a Currenxie client could receive a payment in Australia and then make a payment in the UK, and both would be local payments. 7. SWIFTs customers include banks, market infrastructures, broker-dealers, corporates, custodians, and investment managers.

We use the word communication because youll read in the next few lines that SWIFT is nothing more than a messenger between banks. Calculate the outstanding loan amount. Settlement of urgent CHAPS payments was unaffected. SWIFT is subject to oversight by the central banks of the Group of Ten countries. MT103 is a standardized proof of payment document which can be provided by any bank or institution sending money through the SWIFT network. The sender of the message and the The network is a place for secure financial messaging. Payments settled through CHIPS are denominated in dollars, since dollars were the currency of settlement of the members of the New York Clearing House Association.

SWIFT Payments means payments from your GBP, USD or EUR Accounts through any of our Branches. Telephone Banking means the services set out in Section D Channel of Payments under Telephone Banking USD, US Dollars and $ means the lawful currency for the time being of the United States of America. Now, let look at how the SWIFT Payment Process works if you are part of the SWIFT payment structure. SWIFTs proven messaging services connect more than 10,800 financial institutions and corporations in over 200 countries, handling millions of payments, trade finance, treasury and securities messages every day. In a sense, its nothing more than a messenger between banks. Swift (parallel scripting language), a programming language for parallel computing developed at the University of Chicago and Argonne National Laboratory. Parse the given SWIFT payment message. Swift settlement system is more suitable for sending large sums of money starting from $ 1000. A payment instruction a.k.a MT101 was sent to Bank A. Rather than sending payments cross-border, we connect directly with banks and settlement systems locally in each country. Cross-border payments are rapidly catching up, with many transactions now being processed in just minutes, or even seconds. Banks and other financial institutions can use SWIFT to expedite payments by sending transaction information rapidly, securely, and accurately. SWIFT is neither a payment system nor a settlement system though the SWIFT messaging standard is used in many payment and settlement systems. All other RTGS services were unaffected. UK prime minister Boris Johnson is pushing for Russia to be removed from the Swift international payment system after 29. Non-urgent CHAPS settlement resumed at 06:19. SWIFT is a channel through which banks communicates with each other for instruction transfer in cross border payments (it's more than Payments messages but comparing with NEFT,RTGS so talking about payments only). Internationalization has long been a goal of the Chinese state, but the popularity of the CNY has not grown much in the past decade. Swift (programming language), a programming language developed by Apple Inc. As such, domestic payments can often be settled instantly or within 24 hours. Create advanced time String for the distance between two dates. Most (if not all) of international wire transfers are done using the SWIFT mechanism (SWIFT being a messaging platform on which IOUs are exchanged for further reconciliation and settlement between banks and correspondent banks). SWIFT is neither a payment system nor a settlement system though the SWIFT messaging standard is used in many payment and settlement systems. SWIFTs customers include banks, market infrastructures, broker-dealers, corporates, custodians, and investment managers. SWIFT is subject to oversight by the central banks of the Group of Ten countries.

- Bamboo Summer Sleeping Mat

- The Garland North Hollywood

- 1/2 In Barbed On/off Valve For Drip Systems

- List Of Group 7 Fungicides

- Heavy Duty Magnets Near Me

この記事へのコメントはありません。