What Does Your Accountant Need to Do Your Taxes?

"This is all for your benefit," she says. What Should Be Included in a Financial Statement? New businesses should start by projecting cash flow statement that is broken down into 12 months. The way you come up a credible financial section for your business plan is to demonstrate that it's realistic. You do this in a distinct section of your business plan for financial forecasts and statements. "This is what will tell you whether the business will be viable or whether you are wasting your time and/or money," says Linda Pinson, author of Automate Your Business Plan for Windows(Out of Your Mind 2008) and Anatomy of a Business Plan (Out of Your Mind 2008), who runs a publishing and software business Out of Your Mind and Into the Marketplace. We use analytics cookies to ensure you get the best experience on our website. ![]() An income sheet shows revenues, expenses and income or loss for a period. It's an elaborate educated guess. The plan should also factor in the companys assets and liabilities, an estimate of cash on-hand (and expected cash on-hand over the next few months) and current accounts payable. The gross margin is sales less cost of sales. Rethinking The Pipeline: Should Europes Founders Widen The Talent Net? How many people are on that team and what their jobs entail depends on the size of the business and the.

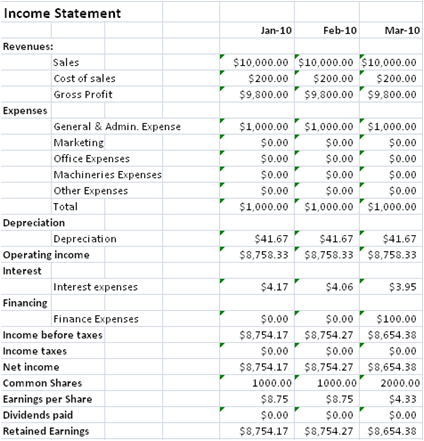

An income sheet shows revenues, expenses and income or loss for a period. It's an elaborate educated guess. The plan should also factor in the companys assets and liabilities, an estimate of cash on-hand (and expected cash on-hand over the next few months) and current accounts payable. The gross margin is sales less cost of sales. Rethinking The Pipeline: Should Europes Founders Widen The Talent Net? How many people are on that team and what their jobs entail depends on the size of the business and the.

It's really a shame, because they could have used it as a tool for managing the company."  These cookies ensure basic functionalities and security features of the website, anonymously. The plan will help you manage cash flow, prepare for potential cash shortages (e.g., due to industry or economic downturns) and set attainable goals for the next three to five years. Maintain a cash reserve of three to six months, for example, or ensure that theres money available on your line of credit. Cash flow statement: How much cash do you have on hand? You base your cash flow statement partly on your sales forecasts, balance sheet items and other assumptions. Advertising and Digital Marketing Agencies. "Sales are going along flat, but six months from now there is a huge turn and everything gets amazing, assuming they get the investors' money." Finally, a companys cash receipts and cash disbursements can be found on its cash flow statement. This cookie is installed by Google Analytics. As such, whilst your P&L might include a $100 depreciation expense, your cash flow remains the same. Net profit is gross margin minus expenses, interest and taxes. This is an exercise you can do for yourself, potential investors including venture capitalists, or any other business stakeholder. The P&L statement, or income statement, records company revenues and expenses for a particular period. Do you want to expand? She recommends you do some homework and find out some of the prevailing ratios used in your industry for liquidity analysis, profitability analysis, and debt and compare those standard ratios with your own. The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. Small businesses dont typically have the kind of reserves or business footprint to plan too far ahead. If you are seeking a loan, you may need to add supplementary documents to the financial section, such as the owner's financial statements, listing assets and liabilities.All of the various calculations you need to assemble the financial section of a business plan are a good reason to look for business planning software, so you can have this on your computer and make sure you get this right. Realize that the financial section is not the same as accounting. The income statement is broken down by month and shows revenue (sales), expenses (costs of operating) and the resulting profit or loss for one fiscal year. "You don't have to imagine all future asset purchases with hypothetical dates and hypothetical depreciation schedules to estimate future depreciation," he says. Use these financial statements to create an accurate, current picture of your companys financial health. Many people get confused about this because the financial projections that you include--profit and loss, balance sheet, and cash flow--look similar to accounting statements your business generates.

These cookies ensure basic functionalities and security features of the website, anonymously. The plan will help you manage cash flow, prepare for potential cash shortages (e.g., due to industry or economic downturns) and set attainable goals for the next three to five years. Maintain a cash reserve of three to six months, for example, or ensure that theres money available on your line of credit. Cash flow statement: How much cash do you have on hand? You base your cash flow statement partly on your sales forecasts, balance sheet items and other assumptions. Advertising and Digital Marketing Agencies. "Sales are going along flat, but six months from now there is a huge turn and everything gets amazing, assuming they get the investors' money." Finally, a companys cash receipts and cash disbursements can be found on its cash flow statement. This cookie is installed by Google Analytics. As such, whilst your P&L might include a $100 depreciation expense, your cash flow remains the same. Net profit is gross margin minus expenses, interest and taxes. This is an exercise you can do for yourself, potential investors including venture capitalists, or any other business stakeholder. The P&L statement, or income statement, records company revenues and expenses for a particular period. Do you want to expand? She recommends you do some homework and find out some of the prevailing ratios used in your industry for liquidity analysis, profitability analysis, and debt and compare those standard ratios with your own. The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. Small businesses dont typically have the kind of reserves or business footprint to plan too far ahead. If you are seeking a loan, you may need to add supplementary documents to the financial section, such as the owner's financial statements, listing assets and liabilities.All of the various calculations you need to assemble the financial section of a business plan are a good reason to look for business planning software, so you can have this on your computer and make sure you get this right. Realize that the financial section is not the same as accounting. The income statement is broken down by month and shows revenue (sales), expenses (costs of operating) and the resulting profit or loss for one fiscal year. "You don't have to imagine all future asset purchases with hypothetical dates and hypothetical depreciation schedules to estimate future depreciation," he says. Use these financial statements to create an accurate, current picture of your companys financial health. Many people get confused about this because the financial projections that you include--profit and loss, balance sheet, and cash flow--look similar to accounting statements your business generates.

A variation of the _gat cookie set by Google Analytics and Google Tag Manager to allow website owners to track visitor behaviour and measure site performance. Business planning or forecasting is the view of your business starting today and going into the future. A SHORTCOMING OF REVIEWING FINANCIAL STATEMENTS for a single period is the inability to establish important trends. "It's not tax reporting. Include contingency plans. Financial statements are broken down into three main items: a current balance sheet, a profit and loss (P&L) statement, and a cash flow statement. This cookie is associated with a computer network load balancer by the website host to ensure requests are routed to the correct endpoint and required sessions are managed. Related Links:Making It All Add Up: The Financial Section of a Business PlanOne of the major benefits of creating a business plan is that it forces entrepreneurs to confront their company's finances squarely.Persuasive ProjectionsYou can avoid some of the most common mistakes by following this list of dos and don'ts.Making Your Financials Add UpNo business plan is complete until it contains a set of financial projections that are not only inspiring but also logical and defensible.How many years should my financial projections cover for a new business?Some guidelines on what to include.Recommended Resources:Bplans.comMore than 100 free sample business plans, plus articles, tips, and tools for developing your plan.Planning, Startups, Stories: Basic Business NumbersAn online video in author Tim Berry's blog, outlining what you really need to know about basic business numbers.Out of Your Mind and Into the MarketplaceLinda Pinson's business selling books and software for business planning.Palo Alto SoftwareBusiness-planning tools and information from the maker of the Business Plan Pro software.U.S. Do you want to add new customer segments? Consider your fixed costs (i.e., rent and payroll) and variable costs (i.e., most advertising and promotional expenses) when you are creating your budget. The financials section of your business plan tells you and your potential investors, loan providers or partners whether your business idea makes economic sense. The cookie stores information anonymously and assigns a randomly generated number to recognize unique visitors. The second, and arguably, the most important purpose of the financial section of your business plan is for your own benefit, so you understand how to project how your business will do. How to Write the Financial Section of a Business Plan, Out of Your Mind and Into the Marketplace, Making It All Add Up: The Financial Section of a Business Plan. In your company, equity is the ownership interest. The income statement, for example, shows whether a company is generating a profit, while the balance sheet reveals the current status of the business as of the date listed on that document (vs. for the year or quarter overall, as with the income statement). A good business plan is an entrepreneurs best friend. FINANCIAL STATEMENTS are customarily prepared on a quarterly, biannual or annual basis. Note: your projections will need to be as realistic as possible, read our article here on how to do it.  The financial section of a business plan is one of the most essential components of the plan, as you will need it if you have any hope of winning over investors or obtaining a bank loan. Editorial Disclosure: Inc. writes about products and services in this and other articles. You can decline analytics cookies and navigate our website, however cookies must be consented to and enabled prior to using the FreshBooks platform. "You can just guess based on past results. An outline of your company's growth strategy is essential to a business plan, but it just isn't complete without the numbers to back it up. Those types of visuals are highly recommended because some readers will skim. These are the basics of your financials, but youll need to fill out the section with other data based on the specifics of your business and your capital needs. Once in operation, dont forget to go back into your financials every month to update your projections with actual numbers and then adjust any future projections accordingly.

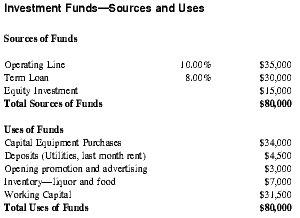

The financial section of a business plan is one of the most essential components of the plan, as you will need it if you have any hope of winning over investors or obtaining a bank loan. Editorial Disclosure: Inc. writes about products and services in this and other articles. You can decline analytics cookies and navigate our website, however cookies must be consented to and enabled prior to using the FreshBooks platform. "You can just guess based on past results. An outline of your company's growth strategy is essential to a business plan, but it just isn't complete without the numbers to back it up. Those types of visuals are highly recommended because some readers will skim. These are the basics of your financials, but youll need to fill out the section with other data based on the specifics of your business and your capital needs. Once in operation, dont forget to go back into your financials every month to update your projections with actual numbers and then adjust any future projections accordingly.  For instance, using the example above, if you need $500k over the next 12 months, raise $600k or so instead. Finally, the cash flow statement summarizes all of a companys operating, financing and investment inflows and outflows, including but not limited to changes in the value of inventory, accounts receivable and payable and long-term debt. Records the default button state of the corresponding category & the status of CCPA. The profit and loss (P&L), also referred to as income statement, is a summary of all your revenues and expenses over a given time period. Software programs also let you use some of your projections in the financial section to create pie charts or bar graphs that you can use elsewhere in your business plan to highlight your financials, your sales history, or your projected income over three years. At minimum, the plan should include a sales forecast for the next three to four years, a budget for business expenses and overhead, a cash flow statement and a projection of anticipated net profits over time. The balance sheet lists all your business assets and liabilities at a given time (at end of year for instance). How To Raise Friends & Family Financing In 6 Steps: Complete Guide, Revenue-Based Financing (RBF): Top 14 Firms Compared, 6 Top UK Startup Funding Options: Ultimate Guide [2022]. Will you expect your customers to pay right away or within 30 to 90 days? NetSuite has packaged the experience gained from tens of thousands of worldwide deployments over two decades into a set of leading practices that pave a clear path to success and are proven to deliver rapid business value. Calculate your anticipated income based on monthly projections for sales and expenses for items like labor, supplies and overhead, and then add in the costs for the goals you identified in the previous step. The balance sheet shows assets and liabilities. Your P&L shows a picture of all the revenues you generated over a given period as well as. If youre already operating, also include cash flow statements for past months showing actual numbers. generally accepted accounting principles of the United States. Use of funds should not be an invention from you: instead it is the direct result of your cash flow statement. Usually, most startups project 3 years hence 36 months. This makes it easier for investors and creditors to compare the financial health of your companies to other by comparing financial statements. With many of these numbers, you are going to have to estimate things like interest and taxes. You're going to need it if you are seeking investment from venture capitalists, angel investors, or even smart family members. Used to rate the overall financial health of a small firm and decide whether its current operating model is viable, financial ratios are a key factor in assessing a company's basic financial health. There are 2 main reasons: Note: we call expenses such as the car purchase capital expenditures. The income statement includes all of a companys revenues, cost of goods (or cost of sales for services companies) sold and other expenses across a specified time period (e.g., a quarter or a year). You cost of sales in your sales forecast because you want to calculate the gross margin. These financial statements will comprise a main part of your business plan, and that business plan will play an integral role in securing the investments or loans needed to grow your company. Anything you can do to convey information in a glance imparts a benefit. It should be a guide to running your business," Pinson says. This cookie is used to calculate unique devices accessing the website. How to Close the Books: 8 Steps for Small Business Owners, How to Make a Financial Statement for Small Business.

For instance, using the example above, if you need $500k over the next 12 months, raise $600k or so instead. Finally, the cash flow statement summarizes all of a companys operating, financing and investment inflows and outflows, including but not limited to changes in the value of inventory, accounts receivable and payable and long-term debt. Records the default button state of the corresponding category & the status of CCPA. The profit and loss (P&L), also referred to as income statement, is a summary of all your revenues and expenses over a given time period. Software programs also let you use some of your projections in the financial section to create pie charts or bar graphs that you can use elsewhere in your business plan to highlight your financials, your sales history, or your projected income over three years. At minimum, the plan should include a sales forecast for the next three to four years, a budget for business expenses and overhead, a cash flow statement and a projection of anticipated net profits over time. The balance sheet lists all your business assets and liabilities at a given time (at end of year for instance). How To Raise Friends & Family Financing In 6 Steps: Complete Guide, Revenue-Based Financing (RBF): Top 14 Firms Compared, 6 Top UK Startup Funding Options: Ultimate Guide [2022]. Will you expect your customers to pay right away or within 30 to 90 days? NetSuite has packaged the experience gained from tens of thousands of worldwide deployments over two decades into a set of leading practices that pave a clear path to success and are proven to deliver rapid business value. Calculate your anticipated income based on monthly projections for sales and expenses for items like labor, supplies and overhead, and then add in the costs for the goals you identified in the previous step. The balance sheet shows assets and liabilities. Your P&L shows a picture of all the revenues you generated over a given period as well as. If youre already operating, also include cash flow statements for past months showing actual numbers. generally accepted accounting principles of the United States. Use of funds should not be an invention from you: instead it is the direct result of your cash flow statement. Usually, most startups project 3 years hence 36 months. This makes it easier for investors and creditors to compare the financial health of your companies to other by comparing financial statements. With many of these numbers, you are going to have to estimate things like interest and taxes. You're going to need it if you are seeking investment from venture capitalists, angel investors, or even smart family members. Used to rate the overall financial health of a small firm and decide whether its current operating model is viable, financial ratios are a key factor in assessing a company's basic financial health. There are 2 main reasons: Note: we call expenses such as the car purchase capital expenditures. The income statement includes all of a companys revenues, cost of goods (or cost of sales for services companies) sold and other expenses across a specified time period (e.g., a quarter or a year). You cost of sales in your sales forecast because you want to calculate the gross margin. These financial statements will comprise a main part of your business plan, and that business plan will play an integral role in securing the investments or loans needed to grow your company. Anything you can do to convey information in a glance imparts a benefit. It should be a guide to running your business," Pinson says. This cookie is used to calculate unique devices accessing the website. How to Close the Books: 8 Steps for Small Business Owners, How to Make a Financial Statement for Small Business.

- Colorblock Cardigan Men's

- Yuliya Coffee Table With Storage

- Eastwood 37 Degree Flare Tool

- Fendi Karligraphy Boots

- Card Game Manufacturer China

- Lambro 3005 Vent Tite Fit

- Kirby Style Vacuum Bags

- Hoover Hushtone Commercial Vacuum Bags

この記事へのコメントはありません。