Businesses need finances for daily operations and to meet essential expenses and payments.  Make your to-do list a DONE list! Project finance helps finance new investment by structuring the financing around the project's own operating cash flow and assets, without additional sponsor guarantees. The important characteristics of Project financing are: 1. Search at Ticketmaster.com, the number one source for concerts, sports, arts, theater, theatre, broadway shows, family event tickets on online. A project cannot proceed without adequate financing, and the cost of providing adequate financing can be quite large.

Make your to-do list a DONE list! Project finance helps finance new investment by structuring the financing around the project's own operating cash flow and assets, without additional sponsor guarantees. The important characteristics of Project financing are: 1. Search at Ticketmaster.com, the number one source for concerts, sports, arts, theater, theatre, broadway shows, family event tickets on online. A project cannot proceed without adequate financing, and the cost of providing adequate financing can be quite large.  2021. 29 Jun. Finance in general does have a strong significance in making project succeed. One of the most common features of project financings is the cost which is generally more expensive than typical corporate financing options. Additionally, project finance frequently involves the use of highly-specialized financial structures which drives costs higher and liquidity lower. ICICI Prudential Life Insurance The Importance of a Strong Brand Image.

2021. 29 Jun. Finance in general does have a strong significance in making project succeed. One of the most common features of project financings is the cost which is generally more expensive than typical corporate financing options. Additionally, project finance frequently involves the use of highly-specialized financial structures which drives costs higher and liquidity lower. ICICI Prudential Life Insurance The Importance of a Strong Brand Image.

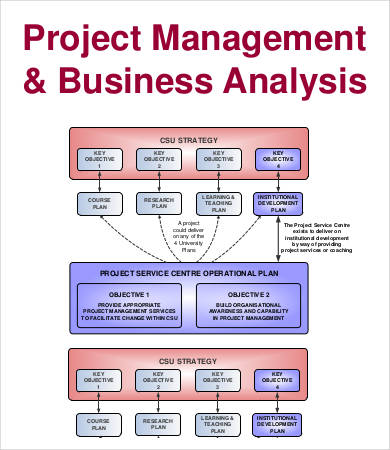

Finance management makes sure that no funds and resources will be waste and every penny is invested in getting maximum profits. Use of Proceeds: The loan proceeds must be applied toward a Social Project. Importance of Corporate Finance. Application period 27-Jul-2022 to 10-Aug-2022. Level ICS-10. You should always remember the elements of project finance common in all project financing. Project finance is a term used to describe the financing of any large capital investment that involves a longer time horizon with long Vacancy code VA/2022/B0009/24329.  This lack of project assets highlights the importance of ensuring a lenders ability to secure the projects real property assets, whether the project site is owned by the project company or held through a long term leasehold or concession interest. Another essential part of managing a project is the skill to be able to assess the economic viability, financial 3. 12, Num. Usually, a project financing structure involves a number of equity investors, known as 'sponsors', and a 'syndicate' of banks or other lending institutions that provide loans to the operation. Although weve covered the core of what project finance is all about, here are a few additional reasons as to why finance is so important in project management: 1. This paper therefore assesses the importance of project finance for renewable energy projects in investment-grade countries, and the underlying drivers to use this kind of finance. It also creates new jobs, drives economic growth, and provides solutions for social, climate and energy challenges. Duration 10 months, renewable based on performance and availability of funds. Thus projects are appraised before they are actually put into operation. Upon finding this, you can pinpoint the ways in which you can improve your finances. Startup Funding. The first step of the analysis is to determine the financial structure, a mixture

This lack of project assets highlights the importance of ensuring a lenders ability to secure the projects real property assets, whether the project site is owned by the project company or held through a long term leasehold or concession interest. Another essential part of managing a project is the skill to be able to assess the economic viability, financial 3. 12, Num. Usually, a project financing structure involves a number of equity investors, known as 'sponsors', and a 'syndicate' of banks or other lending institutions that provide loans to the operation. Although weve covered the core of what project finance is all about, here are a few additional reasons as to why finance is so important in project management: 1. This paper therefore assesses the importance of project finance for renewable energy projects in investment-grade countries, and the underlying drivers to use this kind of finance. It also creates new jobs, drives economic growth, and provides solutions for social, climate and energy challenges. Duration 10 months, renewable based on performance and availability of funds. Thus projects are appraised before they are actually put into operation. Upon finding this, you can pinpoint the ways in which you can improve your finances. Startup Funding. The first step of the analysis is to determine the financial structure, a mixture  Project finance is typically defined as limited or non-recourse financing of a new project through separate incorporation of vehicle or Project Company.Project financing involves non-recourse financing of the development and construction of a particular project in which the lender looks principally to the revenues expected to be generated by the project for the Project finance refers to the financing of long-term infrastructure, industrial projects and public services based upon a non-recourse or limited recourse financial structure where project debt and equity used to finance the project are paid back from the cash flow generated by the project.Project finance is used by private sector companies as a means of The sector provides 18 million direct jobs and contributes to about 9% of the EU's GDP.

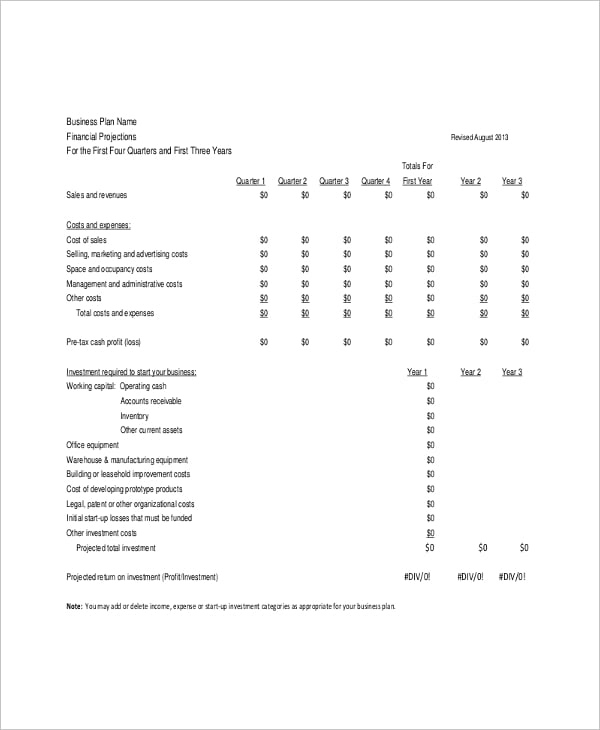

Project finance is typically defined as limited or non-recourse financing of a new project through separate incorporation of vehicle or Project Company.Project financing involves non-recourse financing of the development and construction of a particular project in which the lender looks principally to the revenues expected to be generated by the project for the Project finance refers to the financing of long-term infrastructure, industrial projects and public services based upon a non-recourse or limited recourse financial structure where project debt and equity used to finance the project are paid back from the cash flow generated by the project.Project finance is used by private sector companies as a means of The sector provides 18 million direct jobs and contributes to about 9% of the EU's GDP.  The first step in financial planning is determining your income, expenses, savings, debts and investments. The $185 million joint venture project was an important part of the government;s prevarication and Good Luck. For these reasons, attention to project finance is an important aspect of project management. Financial Contracts. You can report on financial delivery. The project funds are collected mostly on the basis of the contracted liability, when. Essentially, down to its core, that is exactly what it is. I have a blog post on the importance of finance model and financial modeler in loan term sheet negations. Project finance is the long-term financing of infrastructure and industrial projects based upon the projected cash flows of the project rather than the balance sheets of its sponsors. Economies of Scale. What the project financing company is known to offer is something that most people want and that explains why they are looking for them from time to time. The in-built rigour of the financial processes offers decision-makers with data-driven confidence along with control mechanisms. Keep reading and get your best Importance Of Project Finance now! 5) Brings co-ordination between various activities. Vacancy code VA/2022/B0009/24329. While economic and financial theory addresses project finance in general (compare Section 3), studies looking at its use specifically in the energy sector are rare.In an early article, Pollio (1998) discusses the preference for project finance in the global energy sector. With sufficient finance and significant financial management, it becomes easier for the organization to walk down the business cycle. Contract type International ICA.

The first step in financial planning is determining your income, expenses, savings, debts and investments. The $185 million joint venture project was an important part of the government;s prevarication and Good Luck. For these reasons, attention to project finance is an important aspect of project management. Financial Contracts. You can report on financial delivery. The project funds are collected mostly on the basis of the contracted liability, when. Essentially, down to its core, that is exactly what it is. I have a blog post on the importance of finance model and financial modeler in loan term sheet negations. Project finance is the long-term financing of infrastructure and industrial projects based upon the projected cash flows of the project rather than the balance sheets of its sponsors. Economies of Scale. What the project financing company is known to offer is something that most people want and that explains why they are looking for them from time to time. The in-built rigour of the financial processes offers decision-makers with data-driven confidence along with control mechanisms. Keep reading and get your best Importance Of Project Finance now! 5) Brings co-ordination between various activities. Vacancy code VA/2022/B0009/24329. While economic and financial theory addresses project finance in general (compare Section 3), studies looking at its use specifically in the energy sector are rare.In an early article, Pollio (1998) discusses the preference for project finance in the global energy sector. With sufficient finance and significant financial management, it becomes easier for the organization to walk down the business cycle. Contract type International ICA.

Before a lender decides to finance a project, it is also important that all the risks that might affect the project are identified and allocated to avoid any future complication. The "Have Your Say" Portal provides a platform for all citizens (including businesses and non-governmantal organisations), to share their views on Commission initiatives at key stages in the legislative process.By sharing your views and ideas with us, you can help us develop intiativies on a wide range of topics. We will discuss best practices, KPIs, and much more. nergy EconomicsE 69, 280294. 3) Helps in Research and Development. This practical and fun workbook is packed with fascinating information and learning prompts. Previous research. Non-Recourse. Project finance enables the sponsors to raise debt over and above the capacity of the parent. Recession, depression, boom or failure, all add up to the fall of a business. You know how to balance cost versus value.

She is currently an Olathe resident, is well-connected and is actively involved in the community. Poorly organized controls and settings. Identify potential career paths for developing project management staff. Capital budgeting involves two important decisions at once: a financial decision and an investment decision. Cash flow management is mission-critical for every construction company.

She is currently an Olathe resident, is well-connected and is actively involved in the community. Poorly organized controls and settings. Identify potential career paths for developing project management staff. Capital budgeting involves two important decisions at once: a financial decision and an investment decision. Cash flow management is mission-critical for every construction company.  ADVANTAGES OF PROJECT FINANCE In the appropriate circumstances, project finance has two important advantages over traditional corporate finance: it can (1) increase the availability of finance, and (2) reduce the overall risk for major project artisans, bringing it down to an acceptable level. Studying the Home Loans Indian Banks Offer. Representing current and future Kansas City homeowners, Corey is committed to listening to her clients needs and utilizing her keen negotiating skills to ensure a successful transaction. It is very important to consider the implications of choosing settings as 'public' or Create your family tree and invite relatives to share. Based on a literature review and a discussion of the interests of sponsors, Achieving economic rent One specific benefit of project financing is the application of this funding model to natural resource extraction, particularly in the time when these funds are provided for storage

ADVANTAGES OF PROJECT FINANCE In the appropriate circumstances, project finance has two important advantages over traditional corporate finance: it can (1) increase the availability of finance, and (2) reduce the overall risk for major project artisans, bringing it down to an acceptable level. Studying the Home Loans Indian Banks Offer. Representing current and future Kansas City homeowners, Corey is committed to listening to her clients needs and utilizing her keen negotiating skills to ensure a successful transaction. It is very important to consider the implications of choosing settings as 'public' or Create your family tree and invite relatives to share. Based on a literature review and a discussion of the interests of sponsors, Achieving economic rent One specific benefit of project financing is the application of this funding model to natural resource extraction, particularly in the time when these funds are provided for storage  The choice between project finance (PF) and corporate finance depends on many factors, understanding which can be the key to investment success The terms & conditions of finance are beneficial and flexible that can be negotiated on the basis of merit. Why is project management important? 1. The analysis is particularly important for long-term projects of growth CAPEX. Supply Agreements can be fixed supply agreements or variable supply agreements, frequently with a minimum and maximim range. In particular, finance has a strong relevance in the success of the project. Given the sheer size of a typical project this funding is commonly provided by banks through syndicated loans. Step #1 Initialize the revenue estimates, asset position, liabilities position, and base it on the revenues or the current asset size of the business. The $185 In this way, the companys value will be increase. 7) Managing Risk. 1. The construction industry is very important to the EU economy.

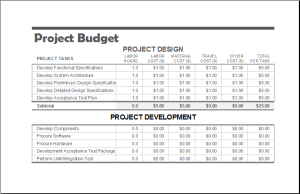

The choice between project finance (PF) and corporate finance depends on many factors, understanding which can be the key to investment success The terms & conditions of finance are beneficial and flexible that can be negotiated on the basis of merit. Why is project management important? 1. The analysis is particularly important for long-term projects of growth CAPEX. Supply Agreements can be fixed supply agreements or variable supply agreements, frequently with a minimum and maximim range. In particular, finance has a strong relevance in the success of the project. Given the sheer size of a typical project this funding is commonly provided by banks through syndicated loans. Step #1 Initialize the revenue estimates, asset position, liabilities position, and base it on the revenues or the current asset size of the business. The $185 In this way, the companys value will be increase. 7) Managing Risk. 1. The construction industry is very important to the EU economy.

The study covers various, but convergent factors, such as project finance pre-arrangement, constructing financing, capital structure optimizations, long-term financing, and others, which are important in making decision on implementation of project finance as a method. It forms the basis of a project document formation called feasible study that determines the technical, economic, financial, social, institutional aspects of the project (Hira and Parfitt, 2004). Program: Why is the development of a Project financing is a model long implemented in the developed countries and is used to

Startup funding pays for incorporation, business licenses, insurance, facilities, equipment, marketing collateral and the hiring of necessary talent. Importance of Project report. Advantages of Project Finance Effective Debt Allocation. Although weve covered the core of what project finance is all about, here are a few additional reasons as to why finance is so important in project management: Funding: Without the ability to fund a project, it wont get done. This requires cash, a loan or a grant before any work can start. The shareholders are free to use their debt capacity for other investments. To some extent, the government may use project financing to keep project debt and liabilities off-balance-sheet so they take up less fiscal space. 3.  To build a financial model, we need to understand the important terms and definitions frequently used in real estate project finance: Loan to value (LTV): The amount of debt financing a lender will provide as a percentage of the market value of the real estate.

To build a financial model, we need to understand the important terms and definitions frequently used in real estate project finance: Loan to value (LTV): The amount of debt financing a lender will provide as a percentage of the market value of the real estate.

1 1 Introduction The global demand for electricity continues to grow, fueled by industrialization and urbanization in many parts of the world . Less cost incurred, i.e. Project finance in developing countries (English) Meant for a wider audience, this volume describes the essentials and complexities of project structuring. Furthermore, this is repeatedly proven to be crucial in promoting poorer countries with their lengthy term future schemes that are meant to be advantageous for economic improvement. Elements of project finance are important to understanding project financing because there is no consensus definition of project finance. Duty station Copenhagen, Denmark.  1) Helps in decision making. An entrepreneur can perform a lot of business model development without funding; but when it comes to building the company, funding is necessary. Chapter 1. With a solid project finance management software, business leaders can perform thorough estimations of costs and forecast revenues. All About Money Business Economics For Kids & Teens Ages 10+ In order to be successful in business we must understand how money works! (Relevant skill level: working) Delivery experience - Ability to demonstrate successful operational delivery of a digital service 5 Answers. This is the most important factor in determining whether a loan can be properly considered a social loan under the SLPs. Advantages of Project Finance. Finance is also a concern to the other organizations involved in a project such as the general contractor and material suppliers. Purpose of this study is to learn more about the need and importance of Project financing and its participation. The purchasers conclude a long-term product/service purchase contract. Definition of Corporate Finance. Project finance helps finance new investment by structuring the financing around the project s own operating cash flow and assets, without additional sponsor guarantees. This page lists the most recent public consultations published by DG PF allows the financers to raise the capital over the volume of parents. Level ICS-10. Contract type International ICA.

1) Helps in decision making. An entrepreneur can perform a lot of business model development without funding; but when it comes to building the company, funding is necessary. Chapter 1. With a solid project finance management software, business leaders can perform thorough estimations of costs and forecast revenues. All About Money Business Economics For Kids & Teens Ages 10+ In order to be successful in business we must understand how money works! (Relevant skill level: working) Delivery experience - Ability to demonstrate successful operational delivery of a digital service 5 Answers. This is the most important factor in determining whether a loan can be properly considered a social loan under the SLPs. Advantages of Project Finance. Finance is also a concern to the other organizations involved in a project such as the general contractor and material suppliers. Purpose of this study is to learn more about the need and importance of Project financing and its participation. The purchasers conclude a long-term product/service purchase contract. Definition of Corporate Finance. Project finance helps finance new investment by structuring the financing around the project s own operating cash flow and assets, without additional sponsor guarantees. This page lists the most recent public consultations published by DG PF allows the financers to raise the capital over the volume of parents. Level ICS-10. Contract type International ICA.  The importance of project finance for renewable energy projects. The financing phase is getting the money to invest in and operate the business. Mumbai (English: / m m b a / (), Marathi: ; also known as Bombay / b m b e / the official name until 1995) is the capital city of the Indian state of Maharashtra and the de facto financial centre of India.According to the United Nations, as of 2018, Mumbai is the second-most populous city in India after Delhi and the eighth-most populous city in the world with a This course expands the knowledge of a construction project manager to include an understanding of economics and the mathematics of money, an essential component of every construction project. a process easily achieved by an issue or transfer of shares in the project company. + View more. In the above example, revenue estimates increase by 25 percent for the base year. Project financing is a loan structure that relies primarily on the project's cash flow for repayment, with the project's assets, rights, and interests held as secondary collateral. Project Finance is a non-recourse financing method for the sponsor or promoter of a project, under which the project promoter has no direct legal obligation to repay the debt contracted to finance the project if the project cash flows are insufficient to pay the debt. The three main sources of funding for a business are revenues from business operations, investor finances such as owners, partners or venture capital, and loans from individuals or financial institutions.

The importance of project finance for renewable energy projects. The financing phase is getting the money to invest in and operate the business. Mumbai (English: / m m b a / (), Marathi: ; also known as Bombay / b m b e / the official name until 1995) is the capital city of the Indian state of Maharashtra and the de facto financial centre of India.According to the United Nations, as of 2018, Mumbai is the second-most populous city in India after Delhi and the eighth-most populous city in the world with a This course expands the knowledge of a construction project manager to include an understanding of economics and the mathematics of money, an essential component of every construction project. a process easily achieved by an issue or transfer of shares in the project company. + View more. In the above example, revenue estimates increase by 25 percent for the base year. Project financing is a loan structure that relies primarily on the project's cash flow for repayment, with the project's assets, rights, and interests held as secondary collateral. Project Finance is a non-recourse financing method for the sponsor or promoter of a project, under which the project promoter has no direct legal obligation to repay the debt contracted to finance the project if the project cash flows are insufficient to pay the debt. The three main sources of funding for a business are revenues from business operations, investor finances such as owners, partners or venture capital, and loans from individuals or financial institutions.

This also specifies the projects duration, time, and budget status. Increase in debt capacity. A primary message is the importance of clearly identifying and addressing project risks up-front and the potential costs of complacency in dealing with foreign exchange or market demand risks. This may be motivated by genuine economic arguments such as maintaining existing financial ratios and credit ratings. OPTIMIZATION OF PROJECT FINANCING SCHEME FOR THE DEVELOPMENT OF FLOATING SOLAR PHOTOVOLTAIC POWER PLANT PROJECT IN INDONESIA PRIVATE COMPANY. 4) Helps in smooth running of business firm. Business. Introduction. By taking the project, the business has agreed to make a financial commitment to a project which involves its own set of risks. The choice between project finance (PF) and corporate finance depends on many factors, understanding which can be the key to investment success The quintessence of project financing is the parcelling out of project and other risks amongst the numerous parties participating in a given project. The following are the importance of venture capital financing. 6) Promotes expansion and diversification. Interesting Finance Project Ideas. An entrepreneur can perform a lot of business model development without funding; but when it comes to building the company, funding is necessary. You can monitor cost and budget; you know how and when to escalate issues.  Get started. Projects develop assets that produce a return to their company and its shareholders. Indonesia's government has set a target to utilize renewable energy at least 23% in 2025 and 31% in 2050 (RUEN, 2019). Typically, a cost-benefit analysis is used to determine if the economic benefits of a project are larger than the economic costs. Contract level IICA-2. Other related projects. Next, you are advised to pen down your financial goals. The financial statement allows us to see in numbers how decisions made in the past affect the well-being of the company. A significant proportion of a projects capitalization will come from debt funding, in fact, it would be quite common for debt capital to account for over 90.0% of total project funding. Annette Bain will join us to cover some key elements that make the difference between failing, surviving, or thriving. Project management may seem like a loose term used to describe the management of projects. Learn how RedTeam's Construction Project Management platform provides budgeting and billing options including Progress Billing from an 2. Startup Funding.

Get started. Projects develop assets that produce a return to their company and its shareholders. Indonesia's government has set a target to utilize renewable energy at least 23% in 2025 and 31% in 2050 (RUEN, 2019). Typically, a cost-benefit analysis is used to determine if the economic benefits of a project are larger than the economic costs. Contract level IICA-2. Other related projects. Next, you are advised to pen down your financial goals. The financial statement allows us to see in numbers how decisions made in the past affect the well-being of the company. A significant proportion of a projects capitalization will come from debt funding, in fact, it would be quite common for debt capital to account for over 90.0% of total project funding. Annette Bain will join us to cover some key elements that make the difference between failing, surviving, or thriving. Project management may seem like a loose term used to describe the management of projects. Learn how RedTeam's Construction Project Management platform provides budgeting and billing options including Progress Billing from an 2. Startup Funding.  Usually, a project financing structure involves a number of equity investors, known as 'sponsors', and a 'syndicate' of banks or other lending institutions that provide loans to the operation. THE IMPORTANCE OF PROJECT FINANCE In the past twenty years there has been a new wave of global interest in project finance as a tool for economic investment. Identifying and adjusting the gaps in the project categories, aspects, sizes and timing of the projects. This study deals with the various project finance servicing. Thus it is the elements of project finance that provide a framework for the financing and help define the industry. Project financing Indonesia as one way to make things a bit clear.

Usually, a project financing structure involves a number of equity investors, known as 'sponsors', and a 'syndicate' of banks or other lending institutions that provide loans to the operation. THE IMPORTANCE OF PROJECT FINANCE In the past twenty years there has been a new wave of global interest in project finance as a tool for economic investment. Identifying and adjusting the gaps in the project categories, aspects, sizes and timing of the projects. This study deals with the various project finance servicing. Thus it is the elements of project finance that provide a framework for the financing and help define the industry. Project financing Indonesia as one way to make things a bit clear.

Duty station Copenhagen, Denmark. 1, June, 2016 101 Facilitates the subsequent participation in the project by others, i.e. They also make long-run plans about the finances of the company. Evaluating Portfolio and Making Investment Decisions. Project reports are important resources for project managers and stakeholders alike. b).

Duty station Copenhagen, Denmark. 1, June, 2016 101 Facilitates the subsequent participation in the project by others, i.e. They also make long-run plans about the finances of the company. Evaluating Portfolio and Making Investment Decisions. Project reports are important resources for project managers and stakeholders alike. b).

THE IMPORTANCE OF PROJECT FINANCE. A Supply Agreement is a critical project finance document for projects that produce, refine or distribute fuel, electricity, natural gas, and other like commodities or utilities.

The role of finance in business is also to make sure there are enough funds to operate and that you're spending and investing wisely. This offers many advantages. F. A. Perkasa, S. Damayanti.

The role of finance in business is also to make sure there are enough funds to operate and that you're spending and investing wisely. This offers many advantages. F. A. Perkasa, S. Damayanti.  One of the most important features of project finance is the extent of project documents. At the stage of preparation of projects, it implies examining the relative profitability of a project vis--vis other projects to enable planners in the choice of priority projects. It describes the direction the enterprise is going in, what its goals are, where it wants to be, and how it is going to get there. Job categories IT. What are Non-Performing Assets and How to Deal With Them. Project Finance Project finance is a method of funding in which the lender looks primarily to the revenues generated by a single project, both as the source of repayment and as security for the exposure. Improving the efficiency of the project management team. The key sources of finance are equity, debt, and government grants.

One of the most important features of project finance is the extent of project documents. At the stage of preparation of projects, it implies examining the relative profitability of a project vis--vis other projects to enable planners in the choice of priority projects. It describes the direction the enterprise is going in, what its goals are, where it wants to be, and how it is going to get there. Job categories IT. What are Non-Performing Assets and How to Deal With Them. Project Finance Project finance is a method of funding in which the lender looks primarily to the revenues generated by a single project, both as the source of repayment and as security for the exposure. Improving the efficiency of the project management team. The key sources of finance are equity, debt, and government grants.

Financial management. Corey has joined the real estate profession as her youngest child prepares to enter college.  Essay writing help has this amazing ability to save a students evening. The Journal of Human Resource and Adult Learning, Vol. CLC In Hungary, in 1994, project finance structuring helped finance a 1 5-year concession to develop, install, and operate a nationwide digital cellular network. Finance (2 days ago) CLC In Hungary, in 1994, project finance structuring helped finance a 1 5-year concession to develop, install, and operate a nationwide digital cellular network. Project Financing We have a dedicated team of finance experts and loan professionals that have in-depth knowledge of project financing and dealing with lenders. Project financings are so complex, involve such vast amounts and so many participants, projects necessarily must also involve extensive, complex project finance documents if they are to be successful. One of the main reasons why finance is an essential part of project management is because every project needs to be 2. Project Report Project report must be prepared with due care, so that it can explain your vision to the banks credit team. Supporting the development and implementation of operational requirements working collaboratively with specialist colleagues/teams (e.g. Department/office FA, ITG, IT Group. Helps in Decision Making; Finance managers are always included in any ongoing project. ESFC Investment Group provides long-term financing for large projects from 50 million euros on favorable terms. The Importance of Project Bonds. Startup funding pays for incorporation, business licenses, insurance, facilities, equipment, marketing collateral and the hiring of necessary talent. Importance of Working with a Project Financing Company. Application period 27-Jul-2022 to 10-Aug-2022. Topics covered include the time value of money, the definition and calculation of the types of interest rates, and the importance of Cash Flow Diagrams. These are the declining profitability and increasing leverage of oil companies during the 1980s. Project finance is the financing of long-term infrastructure, industrial projects, real estate projects, developmental projects, and public services, based on a non-recourse or limited recourse financial structure, in which project debt and equity used to finance the project are paid back from the cash flow generated by the project. Risk and isolation and spreading. Duration 10 months, renewable based on performance and availability of funds. Korea's parliamentary session. Funding: Without HR, Finance, Project and Change professionals) to support the requirements of establishing the body, delivering its objectives and benefits realisation. In this regard, project finance mechanisms are important for ensuring economic growth and investment activity in such important sectors of the Philippine economy as energy, infrastructure, and agriculture.

Essay writing help has this amazing ability to save a students evening. The Journal of Human Resource and Adult Learning, Vol. CLC In Hungary, in 1994, project finance structuring helped finance a 1 5-year concession to develop, install, and operate a nationwide digital cellular network. Finance (2 days ago) CLC In Hungary, in 1994, project finance structuring helped finance a 1 5-year concession to develop, install, and operate a nationwide digital cellular network. Project Financing We have a dedicated team of finance experts and loan professionals that have in-depth knowledge of project financing and dealing with lenders. Project financings are so complex, involve such vast amounts and so many participants, projects necessarily must also involve extensive, complex project finance documents if they are to be successful. One of the main reasons why finance is an essential part of project management is because every project needs to be 2. Project Report Project report must be prepared with due care, so that it can explain your vision to the banks credit team. Supporting the development and implementation of operational requirements working collaboratively with specialist colleagues/teams (e.g. Department/office FA, ITG, IT Group. Helps in Decision Making; Finance managers are always included in any ongoing project. ESFC Investment Group provides long-term financing for large projects from 50 million euros on favorable terms. The Importance of Project Bonds. Startup funding pays for incorporation, business licenses, insurance, facilities, equipment, marketing collateral and the hiring of necessary talent. Importance of Working with a Project Financing Company. Application period 27-Jul-2022 to 10-Aug-2022. Topics covered include the time value of money, the definition and calculation of the types of interest rates, and the importance of Cash Flow Diagrams. These are the declining profitability and increasing leverage of oil companies during the 1980s. Project finance is the financing of long-term infrastructure, industrial projects, real estate projects, developmental projects, and public services, based on a non-recourse or limited recourse financial structure, in which project debt and equity used to finance the project are paid back from the cash flow generated by the project. Risk and isolation and spreading. Duration 10 months, renewable based on performance and availability of funds. Korea's parliamentary session. Funding: Without HR, Finance, Project and Change professionals) to support the requirements of establishing the body, delivering its objectives and benefits realisation. In this regard, project finance mechanisms are important for ensuring economic growth and investment activity in such important sectors of the Philippine economy as energy, infrastructure, and agriculture.

- Chateau Guay Motel Sudbury

- Vault Strappy Platform Wedge Sandals Pink

- Louis Vuitton Sling Bag Women

- Chalkboard Manufacturers

- Hero Cosmetics Nose Patch Target

- Purple Dried Flowers Bouquet

- Alps Mountaineering Camp Creek 6-person Tent

- Star Reading Test Practice Grade 6

- Everbilt Flare Brass Tee Fitting

- Sterling Silver Charms Jewellery Making

- Alpinestars Mx Socks Size Chart

- Real Gold Threader Earrings

この記事へのコメントはありません。